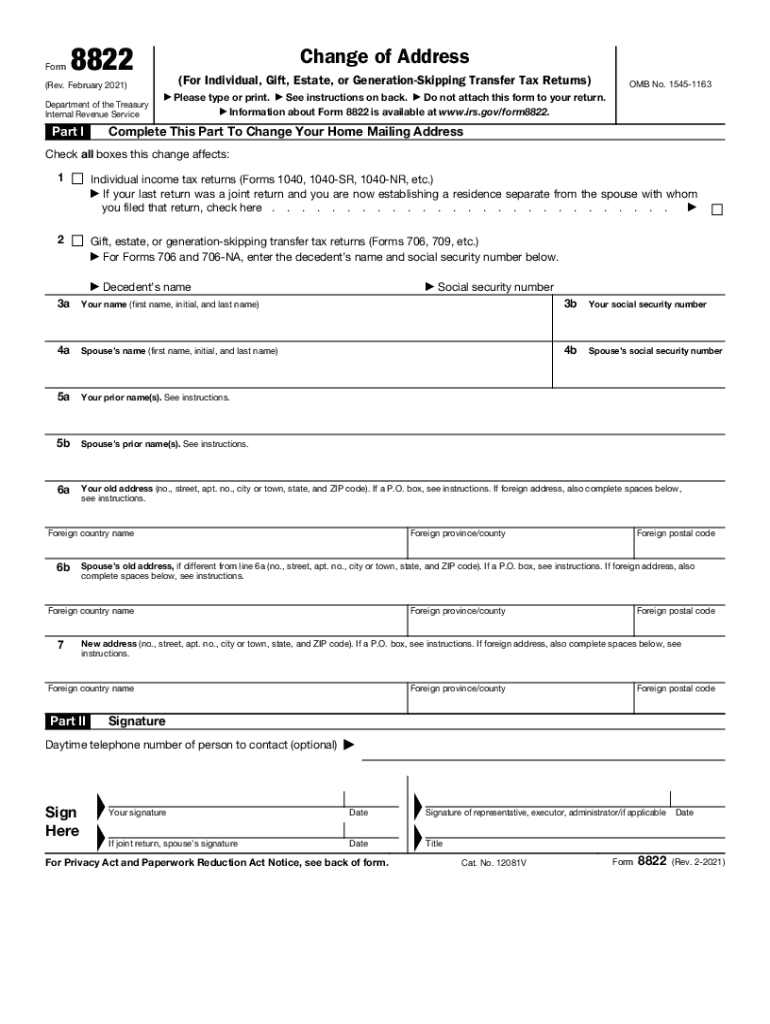

Have you recently moved or had a change in your mailing address? Keeping the IRS informed is crucial to ensure you receive important correspondence. One way to update your address is by filling out IRS Form 8822.

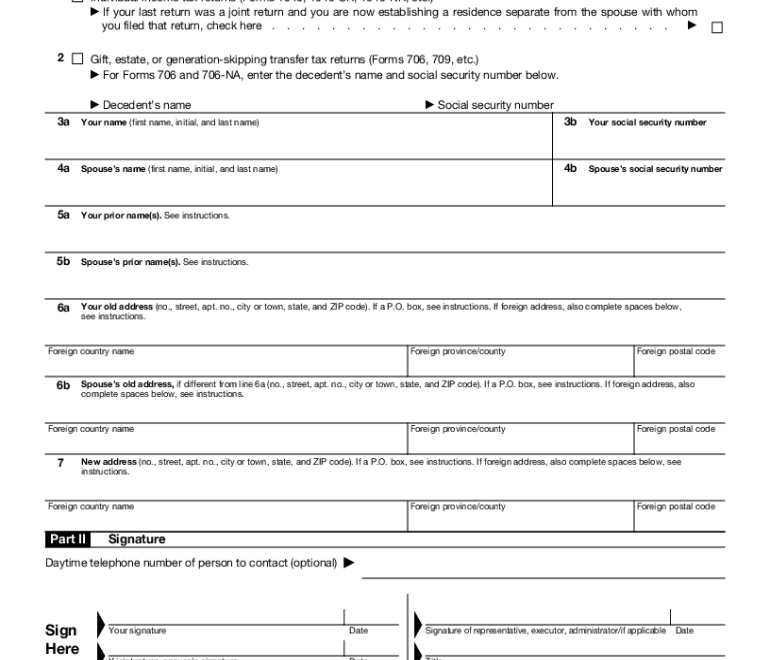

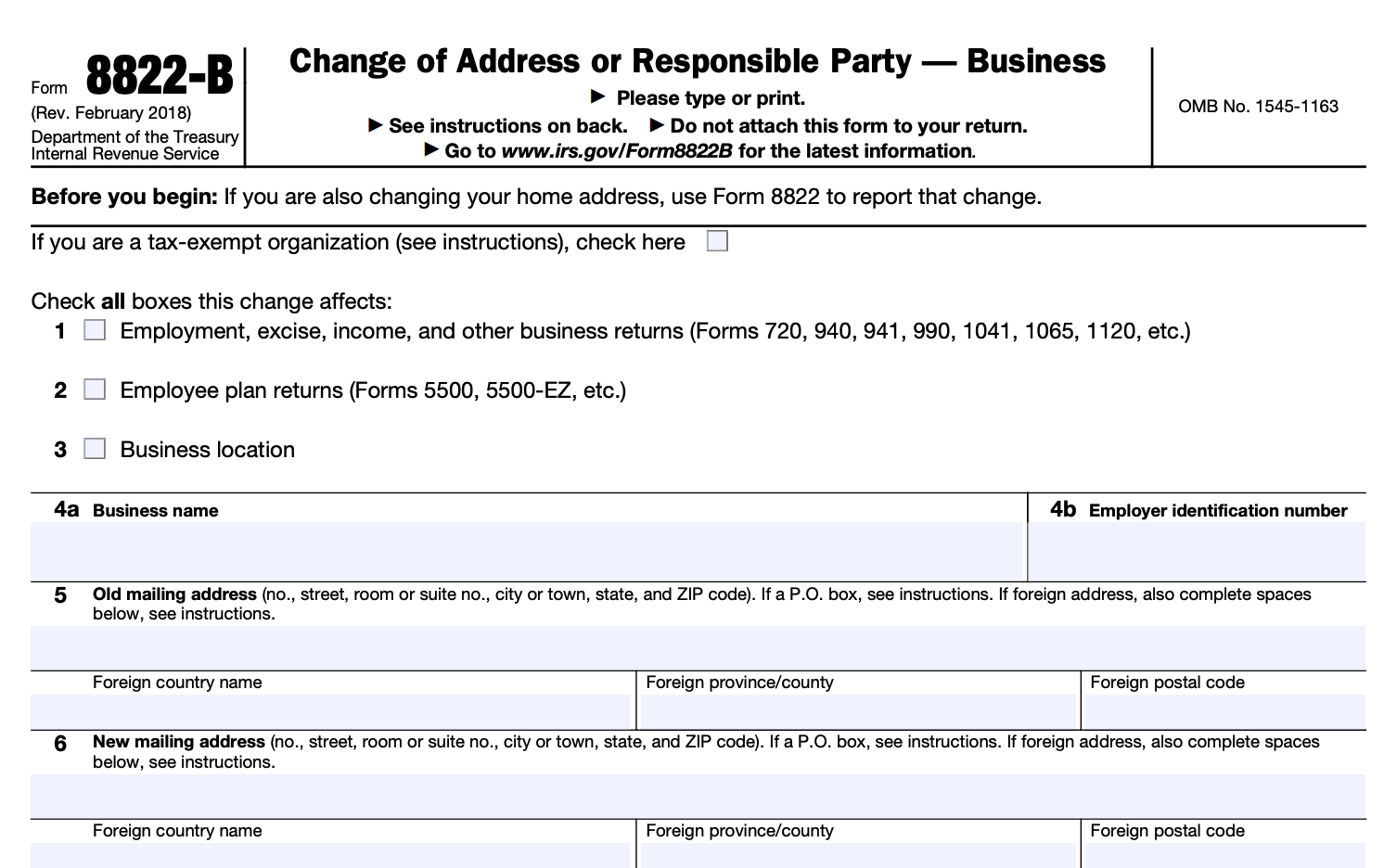

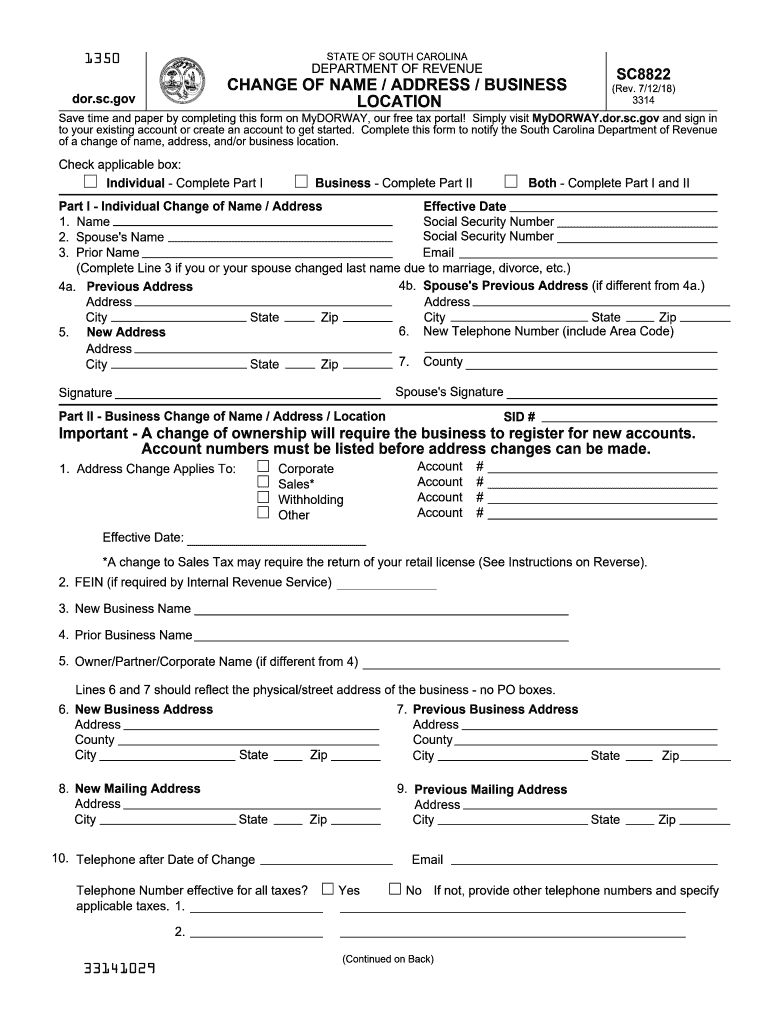

IRS Form 8822 is a simple one-page document that allows you to notify the IRS of your new address. By submitting this form, you can ensure that any future correspondence or refunds will be sent to the correct location.

Irs Form 8822 Printable

Easy Access to IRS Form 8822 Printable

If you’re looking for a convenient way to update your address with the IRS, you can easily find IRS Form 8822 printable online. Simply search for “IRS Form 8822 printable” in your favorite search engine, and you’ll find various websites offering the form for free download.

Once you’ve downloaded the form, fill it out with your updated information, including your old address, new address, and your social security number. Be sure to sign and date the form before sending it to the IRS.

After completing IRS Form 8822, you can mail it to the address listed on the form. It’s essential to submit the form promptly to avoid any delays in receiving important IRS correspondence or refunds. Remember, keeping your address up to date is key to staying in good standing with the IRS.

Updating your address with the IRS doesn’t have to be a complicated process. With IRS Form 8822 printable at your fingertips, you can quickly and easily notify the IRS of your new address. Stay on top of your tax obligations by ensuring the IRS has your current contact information.

Don’t let a change of address lead to missed mail from the IRS. Take a few minutes to fill out IRS Form 8822 and keep your information current. By staying proactive, you can avoid potential issues and stay connected with the IRS.

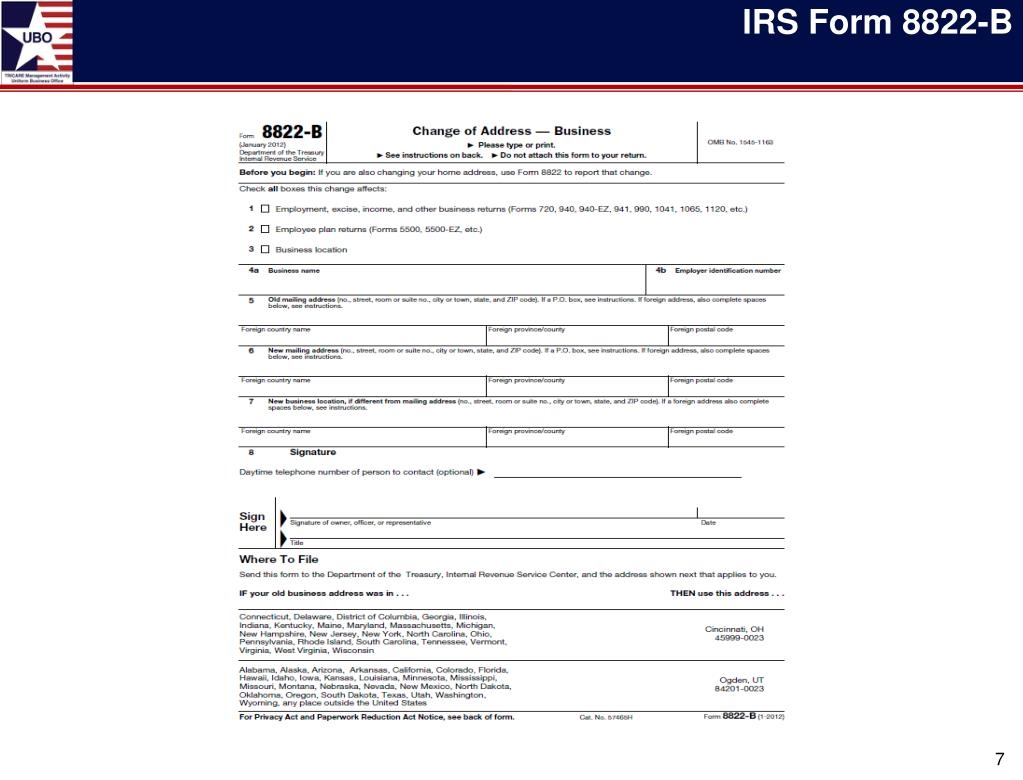

Form 8822 B 2024 2025 How To Fill And Edit PDF Guru

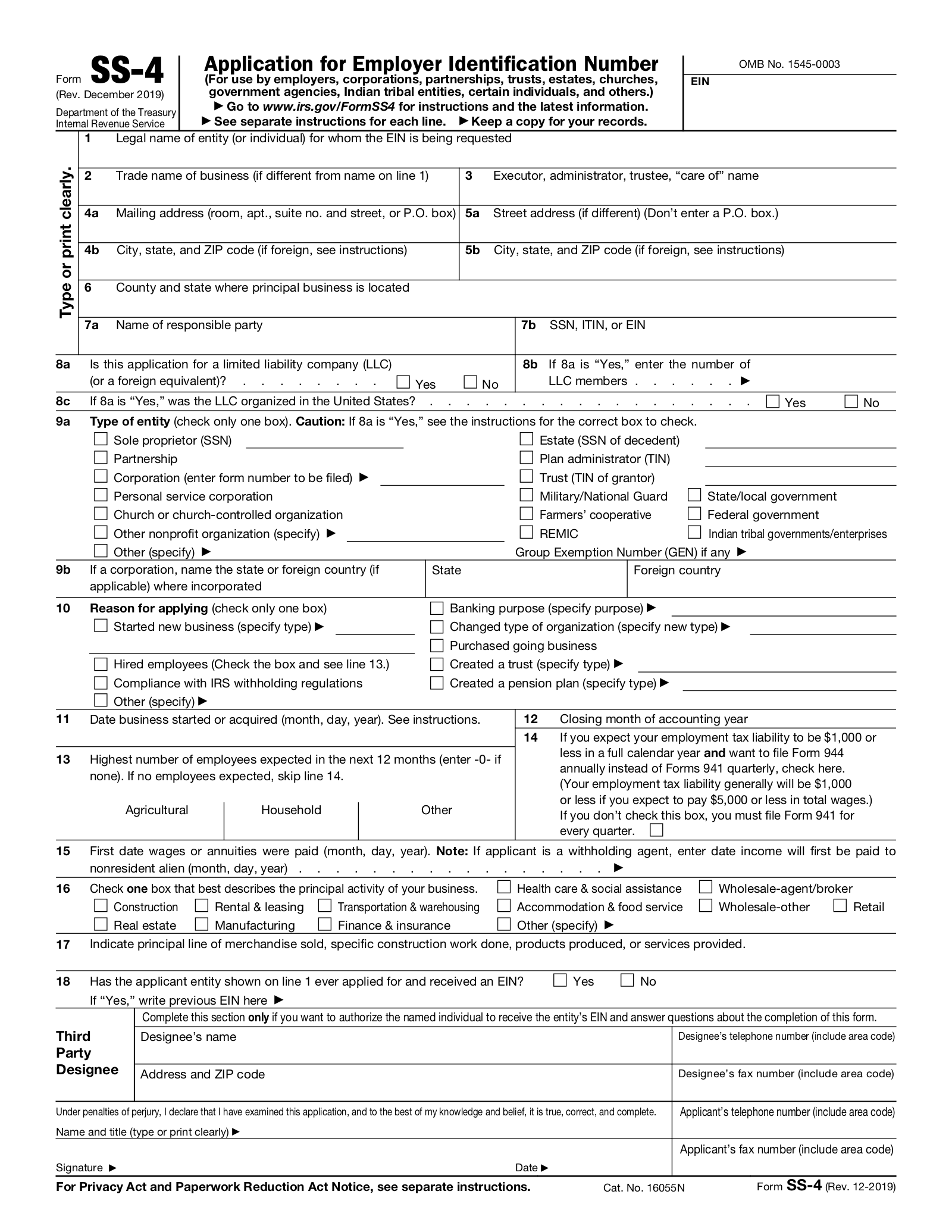

Free SS 4 Application For Employer Identification Number PDF EForms

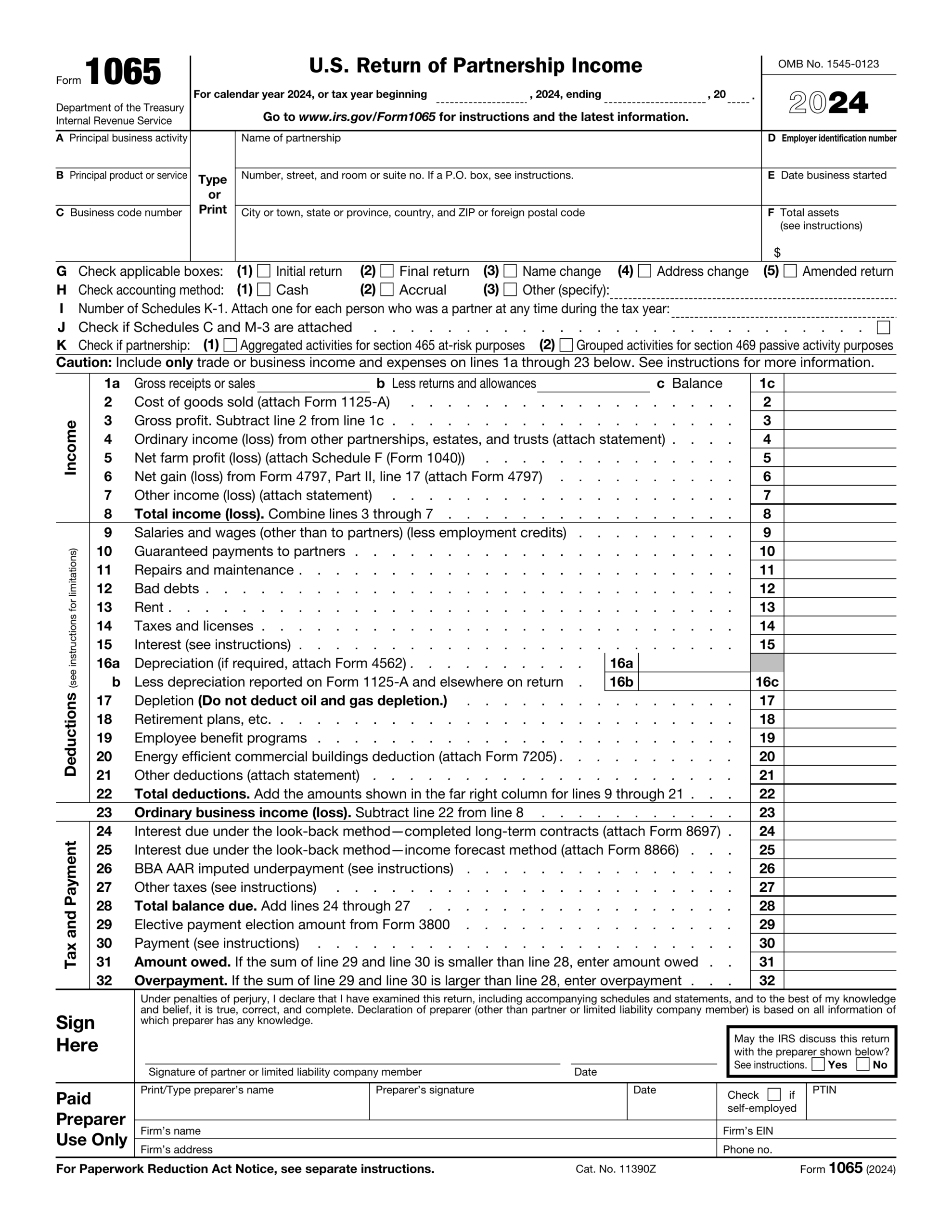

Forms ALA Texas

What Is Form 8822 Fill Out Sign Online DocHub

2021 2025 Form IRS 8822 Fill Online Printable Fillable Blank PdfFiller